Let me set the backdrop here of how a distinguished real estate legacy was created.

His father was a self-made guy who saw the potential for development on Wacker Drive west of the Loop in the late 1950s and started buying older buildings, many on sites where gleaming office towers now stand.

He came to Chicago after going to Harvard Business School (HBS) and landing in the Midwest, because his wife Naomi, an only child, didn’t want to move to New York City.

His son and close friend, Richard sets the scene for us by explaining that when his father got back to Chicago, HBS didn’t mean a whole hell of a lot to anybody. He wanted to be in investment banking, but the truth was, there were only two real investment banking companies in Chicago that mattered, William Blair and Chicago Corp, and they did primarily Rust Belt-type deals.

Richard continues with the conundrum his father faced: He was very entrepreneurial, and the only thing that was entrepreneurial where you could hang your shingle in the Midwest was really real estate.1

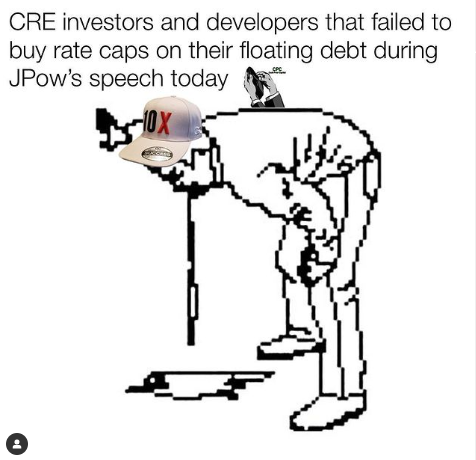

Do you believe the stress has started, and this is the beginning of a wave of wealth creation in distressed multifamily? Do you think some fools overpaid recently?

Have you ever felt the slightest bit of envy wondering how the .001% really invest in commercial real estate without getting their hands dirty, and personally guaranteeing commercial loans?

Have you ever dreamed of running your own fund or syndications? Not just for real estate, but other businesses, opportunities, and endeavors? Such as a Thoroughbred racehorse?

Has the lack of capital or your inability to raise capital meaningfully, and systematically made it prohibitive for you from furthering your career as a professional investor or to be taken seriously?

Do you feel as though learning how to value multifamily is important as raising money for multifamily? What was your first guess?

Do you feel as if you learn the mechanics – from “first call to funding” – that you’d be much more confident explaining your deals to any investor?

Do you value your professional or personal network and want to get it right the first time? Here’s looking at you, fun-loving CPAs, Realtors, and mortgage brokers…

Does the allure of real estate private equity and investment management interest you? Learning what the coveted buy-side is all about?

If we had this conversation one year from now, do you think you’d wished you had mastered raising capital meaningfully before the real distress happens?

Hi, my name is Salvatore Buscemi. Currently I’m the CEO of two-family investment offices (more on that in a second) and have started my career in distressed commercial real estate.

I’ve not only made – but more importantly – have also saved very wealthy families millions of dollars that would’ve created a tremendous about of embarrassment for them and their heirsif they had gone through with those half-baked investments.

So what is this all about? Simply…

1. Crash Course: Commercial Real Estate Valuation

You’ll learn how to value multifamily real estate. Something very few people know how to do. Remember, there are more sellers (brokers) of real estate than people like us who work on the “buy-side”. More on that in a moment.

There’s a common myth in this business that real estate is similar to a bond when – in practice, they are not alike in the least.

The risks in real estate are always more asymmetric than they appear on paper. Valuation is critical. It’s an art and a science.

If you can’t value the asset, you shouldn’t be raising money to buy it.

2. Crash Course: Value-Added Multifamily

This is rehab for grownup real estate investors. And just like rehab in residential, the biggest risk in any value-added deal is the operator. There’s a saying in the business that bad operators turn good deals into bad ones, and good operators turn bad deals into good ones.

I can tell you from my experience running 2 separate distressed credit platforms that the cause for most of these deals blowing up is because of weak, and inexperienced operators – overpaying for an asset and not valuing it appropriately. That’s where most equity impairments lead to and a few other hidden places too.

And that’s how the commercial real estate death spiral happens. But these value-added opportunities can be tremendous wealth creators if – you guessed it – priced and bid the asset correctly. I can tell you from professional experience many multifamily buyers who entered in the last 3 years did not price their assets correctly before buying.

3. Capital Structure

This is my personal favorite as it uncovers a tremendous amount of detail on structured products that – in my experience – very few investors know about or even understand. If you’re raising capital, you’re going to need to answer this one question with a straight answer: “where do you want me in the capital stack?”

You’re expected to know what that means and understand not only the waterfalls and how the beans are split but also the rights and remedies of each structured product. This course does get deep into mezzanine loans and speaks about probably one of the most expensive but little-understood document, the inter-creditor agreement.

Here we talk about the industry jargon that many people don’t understand, just like “Mezz” and “Pref”, until after they’ve committed their money and there’s a problem. Know ahead of time.

4. Funds vs. Joint Venture Structures

Not all securities attorneys are made equal, and not all of them are proficient in math, either. You need to tell them your deal structure explicitly, otherwise, you’re on the hook for their hourly rate to do research and development for you. Then, and again, this is in my experience, can still be wrong.

It can also be embarrassing if you’ve paid a tremendous amount of money to set up a document for a fund when really all you’re looking for is an equity joint venture partner.

The economics are different, the governance is different, and – then there are different carrots and sticks we use to control and manage our investments. Here we talk about negotiated burn-offs, bad-boy clauses, and other industry jargon that many people don’t understand, just like “Mezz” and “Pref”, until after they’ve committed their money and there’s a problem. Know ahead of time.

5. Deal Sourcing and Sponsor Selection

Now that you know the terms, some bond math, and appropriate legal structures to use, it’s time to take a seat at the table with the rest of the grown-ups and private school kids.

Make sure your investors can trust your judgment. Because it’s one thing to raise capital, and it’s an entirely different thing to invest it meaningfully. Ask any professional investor who is protective of their track record.

6. Structuring the Deal & Calling The Capital: How To Execute and Close:

This is when it’s time to lean in and kiss. Learn how to use legitimacy and authority to call the capital without sounding salesy.

Discover how to use tranches and other “carrots and sticks” to motivate your investors to move quickly and not get distracted from your deals and persuade and influence them gently.

Risk is what your friends and family will make fun of your for if your deal goes south. You’re Thanksgivings will never be the same again.

Because there’s almost no regulation, and no one to protect you from overpaying. If you’re raising money, you’re expected to know everything, and are guilty before proven innocent. And, unfortunately in this business, things happen so fast that there is no time to learn on the run.

To make things worse, today in a post pandemic world, there are going to be winner and losers in commercial real estate. Weak and inexperienced investors and operators will be in a world of pain. Those who know how to navigate deftly in these distressed times will prosper and continue their family’s legacy.

This MasterClass is focused more on what we call the buy-side of the business. Unless you worked at a big Wall Street investment bank or a private equity fund, this training was not available to you – until now.

The sheer value of the transactional experience alone is why many people will put themselves into $250,000 of debt to get and MBA from Harvard or Wharton – only to hope to land a job at one of these firms such as Goldman Sachs, Carlyle, or Morgan Stanley. Ask me how I know this.

Just attending this eventwill distinguish you from your competition immediately. Because you’ll never be pushing dated deals and opportunities that the bigger guys have already passed on.

In fact, you know what you’re talking about. Know how the capital structure should look, your models will be on point. You’ll be able to show how much everyone should get paid,how to negotiate the deals to your advantage, how the numbers work and, how to exit with massive profits. And just as important: how to put the pieces together.

This Commercial MasterClass: The Art of the Raise is for those opportunistic investors who see the coming distress and must raise capital. This book will save you hundreds of thousands of dollars in R&D in the form of other’s mistakes.

Accomplished investors looking to build a legacy and for that next level of professional legitimacy by managing money carefully into private asset classes. You’ll understand a combination of different fund structures that most people without practical experience can talk about.

If you’re an Airbnb operator, honestly this event should’ve sold itself by this point as you’ll need to be pooling private debt or equity to buy more product. Because how else are you going to scale your portfolio?

This Multifamily MasterClass is also for successful white-collar professionals such as real estate attorney’s, ambitions accountants, and CCIMs looking to extend their influence into a well-constructed wealth creation mechanism for the mutual benefit of yourselves and your clients.

Know-it-some MBAs who are looking to get that slight practical edge over their peers.

Or even those ambitious accountants looking for a safe gateway to repurposing those longstanding client relationships and their CPA into a wealth creation mechanism. You get the math but need to know the mechanics. We got you covered.

Think about it: It’s far easier to raise money from people who trust you and safely invest it into something that is secured and insured.

And lastly, developers who don’t want to lay in a pool of their own sweat again. You don’t want to take interest rate risk, balance sheet risk, market risk, pledging your personal guarantees again and so forth.

Besides, you don’t much time left for God to give you another cycle.

For those who would have often thought about setting up their family investment offices the same, this is the real magic you want to pay attention to here. Because it’s no longer an elective to do it yourself. You have too much at risk besides money. We both know this.

This MasterClass isn’t for those who are looking to get rich quickly.

Just click the button below here to fill out the contact form on this page so I have your name and email address.

Once you’ve completed Step 1, you’ll then be taken to a page where you can enter your payment information to safely secure your spot.

Unless you worked at a top tier investment bank in New York City, very few people know how these deals are structured.

Because your investors trust you, and you’ll be able to tell them with a straight face that “this is where your dollar investment goes, and this is how it comes back”.

Here’s why:

The market hasn’t experience this much of an interest rate hike shock since 1994. If you spend time sharpening your intellectual ax, you’re going to be much further ahead if you were to try to put the pieces together by doing the same things all the other ignorant amateurs do – such as trying to find the deals before the investors.

If you value your time, you won’t do such a thing.

In all likelihood, these 18 seats will sell out quickly as everyone’s reading the same tea leavesnow. The sky is falling. The distress is palpable with deeds going back to lenders already.

Click the button below to secure your seat with us because this intimate Multifamily Masterclass will sell out.

Also, I’m finishing my 4th book and it will be the preeminent commercial real estate investment managers handbook. So, I need to get my publisher the audios relatively quickly for a spring book release.

Oh – one more thing.

Getting back to Richard’s father, Harvey M. Walken discovered that it was better to take a balance sheet risk – meaning writing a check for an equity investment rather than taking financial, leverage, and operating risk trying to do it yourself. Richard explains this as such:

“So that’s why he went into real estate and ended up building a prolific real estate portfolio. But he was much more of an investor than a real estate developer.

He never bought into the whole ‘be a merchant builder, build a big organization, and build this massive brokerage, development’ and so forth.”

That’s the kill shot, right there.

Which is shown in the form of the various skyscrapers that line Whacker Drive to the Toronto SkyDome.

Think to yourself what else you could do with this powerful skill set to syndicate capital and execute on demand?

Right now, you have 3 choices:

First, you can keep doing the same hoping that single-family residential turns around. Don’t worry, it won’t for a while. We both know this. Remember, denial isn’t only a river in Egypt.

Second, you can be the “Do it Yourself” guy or gal – and look forward to losing life-long friends, enjoy awkward Thanksgivings for decades to come – and get sued for not knowing what you’re doing with other people’s money.

Or you can evolve and invest in a rarified skill set that no one will ever be able to take away from you. Learn to become a real estate equity investment manager.

Because asking people to part with their life’s savings into any investment is the highest form of sales in the land, and it’s why being on the buy side is so coveted on Wall Street.

Oh, and the second rule of real estate is: Never stop raising capital.

You do realize that the market is forcing real estate investors to evolve or get a government job. Because interest rates will destroy home values faster than any hurricane could. You know what you need to do to prepare for this once in a lifetime distressed environment. More wealth creators will be made in real estate now because they will be valuing and purchasing correctly.

Now is the time to fill the void between your experience and relationships with a critical skill set few real estate investors at the lower end have or know anything about.

You’ll be able to evaluate and execute any commercial real estate deal critically. And raise capital on demand. At your discretion. That’s prestige. You don’t have to be afraid of screwing up. Perhaps again.

Isn’t it time you moved on from flipping or selling single-family homes? Because that’s what the public school kids do. Do you want to hang out with the private school kids on the buy side and see what you’ve been missing out on?

Any aspiring real estate entrepreneur who is sincerely interested in evolving as a professional real estate equity fund manager will attend this conference.

It’s higher-priced, for a reason – to separate from the mass of untrustworthy flakes and wannabes from those grownup men and women who are asking themselves: “where am I going to be ten years from now?”

Because free advice from ignorant amateurs is far more expensive. Just ask your brother-in-law.

The comments tell you all you need to know as to what you can expect to discover at the Multifamily MasterClass.

I’ve called the distress in the market before, as evidenced in several ways, but most notably on television in major markets.

And I’ve written some of the most expensive books on real estate investing. Why are they still so expensive? Because they have nothing to do with being a landlord.

And some of the people I’ve had the pleasure of working with over the years in a variety of deals and business partnerships.

Behind the scenes intimate testimonials with some of our most consequential families and investors who matter in our business.

Join us Tuesday and Wednesday, June 13th and 14th, 2023 in Miami where I will be putting on a closed-door Commercial MasterClass: The Art of the Raise at a private residence in West Lake.

This is far different than anything else you’ve probably ever heard of as you’ll discover what the coveted buy-side is in real estate private equity is all about. The secrets, the nuances and the gamesmanship that goes on to get these deals closed.

This specialized skill set will allow you to raise capital on demand for assets, or pool together capital for a fund.

It’s an interesting story.

About 3 years ago I was interviewed by a prominent and beloved San Diego-based podcast host on a development we were performing on a 166,000 square foot Class A Industrial development in Las Vegas.

Soon after, I would get about one direct message a week from someone looking to learn more or asking general questions about raising capital.

Development before the pandemic.

Others reached out asking me if they could be an apprentice or if I offered any sort of coaching programs. Which I don’t.

Then in the middle of 2022, after 67,000 views later, I’ve been getting about a dozen direct messages a week across all my social media accounts, complimenting, criticizing, and wanting to know more about how to get started.

Present day. 100% occupancy.

After starting my career at Goldman Sachs during its old partnership days, I’ve raised hundreds of millions of dollars from Park Avenue institutions for two of my dedicated distressed real estate funds, and currently manage a very well performing venture fund, and am the CEO of two separate family offices, the first being Dandrew Partners (SFO) for the past 20 years.

On a side note, yes, these skills are transferable, and I’ve been able to use them to raise millions of dollars from more sophisticated investors for world-class earlier-staged life sciences companies led by pedigreed CEOs with several exits in our clandestine HRN multi-family investment office.

This workshop will help me fill the void to create the content that my followers want me to place into my next book but will also be used to train our real estate analysts after they graduate from their respective top colleges and universities this coming spring when, in my honest opinion, the distress in multifamily and other commercial sub-asset classes will really starts to kick in.

I figured that the fun is in an interactive audience, as was the case with that interview with Oliver, and it would be great to host a smaller, intimate Multifamily MasterClass which I would show you the blueprint and lay out how capital is raised much easier than you think.

This way, I could fill the critical content I need to so I can publish my 4th book, this one on commercial real estate equity allocation.

Timing is everything in life because regret is the most expensive opportunity risk there is in life. And if you’re not prepared, you’ll miss this distressed cycle too.

Every day you hear of a real estate bust in the news or on television, remember you’re missing out on millions of dollars.

I look forward to seeing you at the next Commercial MasterClass: The Art of the Raise.

Thank you kindly for reading! I hope you learned something new about this business you never knew before.

Sincerely,

Salvatore M. Buscemi

Founder and CEO

PS.The number one reason why professional real estate investors fail is because of this second cardinal rule of real estate, which is – and write this down – never stop raising capital.

You can’t be both timid and successful. If you’re going to depend on banks for financing, just quit now. I’ll save you a fortune.

Because once you discover and understand how to raise capital to place into other people’s deals – meaning sponsors and operators who are more qualified than you – you officially will transition to becoming a Real Estate Equity Investment Manager.

Now lean in. This is how you build a track record, by raising money for other people’s deals first that you participate in before you decide to become an owner-operator yourself, risking your credit, savings, marriage, mental health, etc. Make sense?

Be one of the only 18 to join us at one of my family office’s private residences in Miami, this June 13-14, 2023, so you can focus your time raising capital and allocating it to multifamily operators that you’ve qualified well, rather than going out and doing all the construction and heavy lifting yourself in a distressed market.

Besides, who exerts more influence? Financiers do, of course. Never a home flipper…

The Federal Reserve has raised interest rates by 375 basis points in less than 12 months. Since then, it has already decimated real estate values and has humiliated all those 10x multifamily “rockstars” who paid at the top.

Spending two days with myself and other experienced, institutionally trained buy-side equity investment managers will provide you with a rarefied skill set and a system for being able to search, qualify, value, and invest in any multifamily real estate asset, but more so how to not buy wrong in a distressed market.

Most importantly, you’ll learn how to outsource the critical aspects of this business that aren’t with your time. Like fund administration, which your investors will ask you about to determine if they trust you or not. Use our resources.

You’ll have all the confidence and authority to go out into the market and start your own virtual real estate equity investment company.

Think about it, no matter your experience or where you are in life, your time is far too precious now to be making all the mistakes just starting out. This cycle has 3 years to it. That’s it. Why waste time?

1. Where will this event be held?

At a private residence in Miami. After securing your spot by clicking below you will receive an email with the address, and the name of hotels in the vicinity to stay at. If you’ve not received it, please check your Spam folder.

2. What tools will I get to take home with me?

Professional, Easy-to-Use Excel Models (Value: $5,000)

So you can appropriately value these assets and show your investors you know did your math homework and not relying on a broker’s pro forma. Just like any other real estate private equity professional does.

Pitchbook and Tear Sheet (Value: $5,000 – *If Done Right)

Nothing is more humiliating than pitching your deal so awkwardly that it confuses you and your investors. I’ve seen this novice move too many times. This is so you can show your investors where their money goes – and how it comes back to them in your deals. Because you only get one chance to impress a new investor.

How-To-Phone Help Calls for 4 Weeks after the MasterClass ($7,500)

Live Q&A Zooms every Friday at 10 am Pacific, 1 pm Eastern for 4 weeks after the Multifamily Masterclass with me. Because you will certainly have questions and will need some help. We’ve all been there, and you don’t want to look like a fool. You don’t have enough time.

Email Templates (Value: $10,000)

For pitching the deal and following up. These are written by me, so you can sound authoritative while still being authentic and not too pushy. If you don’t know how to email correctly, it will cost you $10,000 to have a qualified financial copywriter structure these for you in a way that won’t confuse your investors. Because you can’t survive without their attention and the riches are always in the follow-up.

Critical Documents: The Operating Agreement (Price Paid: $50,000 – *If Done Correctly)

There’re documents and then there’s grandma’s nightgown, which covers everything. A copy of this very expensive $50,000 document will be made available for you to give to your attorney to appropriately retrofit your deals. Because you will be judged by your docs by investors and anything in there that is confusing to them will make them run away.

Checklists (Value: Invaluable)

For managing, scheduling, and announcing your deal launches, capital calls, and timelines for document completion and commitments. It makes it easy to scale your real estate equity investment company. Because checklists keep you out of trouble. Just ask any pilot.

3. Will this be streamed?

There are no plans to stream this currently. If you see the waitlist, please place your name on there and we’ll send you an email if we announce we’ve decided to provide a streaming option for people to participate. Of course, all of the tools mentioned above will be emailed to you.

4. What Promises or Guarantees Are There?

None. I don’t know how accomplished you are, your track record, your prior professional experience to know if you’ll be successful or not. Anyone who tells you otherwise is not being truthful. With that said, will you walk out after 2 days knowing more than 98% of the participants in our industry because you’ll be on the buy-side of this business? Of course. Will you know enough to be dangerous? Perhaps. Will your network be stronger so you can transact meaningfully? Yes.

1Actual story from my 3rd book Investing Legacy: How the .001% Invest.

Salvatore Buscemi © | Terms & Conditions | Privacy Policy | Disclaimer