Uncover The Secrets To Private Mortgage Investing With This Ultimate Guide To Mastering The Art Of High-Profit, Low-Risk Real Estate Investments

In the sun-soaked deserts of Arizona, a tale of two aspiring real estate investors began to unfold nearly two decades ago. Two middle-class professionals, united by their shared alma mater and dreams of financial success, embarked on separate journeys into the world of real estate entrepreneurship. Both men, having wed in their late twenties, settled down in the thriving Phoenix suburbs to raise their families.

As fate would have it, their paths diverged when the Great Recession of 2008 struck like a bolt of lightning. One, a computer scientist who had quickly climbed the salary ladder, found his financial foundation crumbling beneath him. He ultimately faced divorce, bankruptcy, and a humbling return to shared living quarters. The other, a medical sales professional, rose from the ashes of the recession and built a multi-generational investment empire.

The poignant story of these two men reveals the stark divide that can emerge between real estate investors when armed with a single book – a tome of knowledge that would come to define their destinies. The question that has haunted many budding investors is this: if the barrier to entry is so low, can it truly be a sound investment?

As our protagonists discovered, the seemingly simple ventures of real estate investing often harbor hidden complexities and costly lessons. Time is a relentless force, and the years slip by with little mercy for those who have stumbled. The most successful investors are those who master the intricacies of buy-side real estate finance – from valuations to capital raising – either through hard-won experience or prestigious investment banking careers.

A decade ago, I penned a groundbreaking book that empowered ordinary investors to thrive in the realm of real estate without donning the landlord’s hat. These individuals yearned to unravel the mystique of the private mortgage business – to master the art of generating passive income through interest rate spreads, points, and the very fees that enrich bankers.

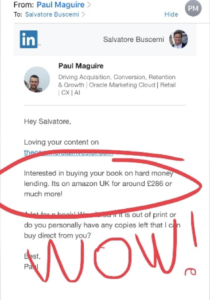

And now, I present to you the re-release of this revolutionary tome – a book that still commands a hefty price on Amazon: “Making The Yield: Real Estate Hard Money Lending Uncovered.” Within its pages, I divulge the comprehensive steps to launching a successful real estate private lending business, drawing upon my vast experience in both lending substantial sums and navigating the turbulent aftermath of the 2008 crisis. I’ve witnessed firsthand the pitfalls and the path to triumph.

The high price tag of this remarkable guide is no accident.

The lower and middle classes often dabble in single-family homes, treating property acquisition as a game of Monopoly. Yet, they possess only one asset – their personal credit. The wealthy, on the other hand, wield influence to raise equity and private debt for their ventures.

The middle class risks their credit and retirement by renting to tenants who are economically disadvantaged and possess inferior credit. As we saw in 2008, and again during the pandemic, political risk is a palpable threat, and irrational local governments can outlast your solvency as a residential landlord.

Upon closing my second institutional distressed real estate credit fund, I was besieged by investors urging me to create a guide on making private equity-based loans against residential real estate at low loan-to-value (LTV) ratios – a handbook for aspiring fund managers seeking success in the world of private loans against real estate. While the concept of private credit dates back to the days of Moses, this book illuminates the path to mastering it without losing money.

The last thing these everyday investors, often lacking formal financial backgrounds, needed was an impenetrable tome riddled with jargon and indecipherable mathematics. They sought a simple, comprehensible approach to making these loans – a testament to the notion that real estate needn’t be overly complicated.

Thus, this book has not only become one of the most expensive on the subject, but also the catalyst for hundreds of millions of dollars raised and judiciously invested in residential real estate for passive income and fees.

Imagine harnessing the innate, visceral understanding of real estate shared by people worldwide, tapping into a fraction of the $20 trillion IRA and 401(k) market that trembles before stocks and yearns for real estate investments. Picture leveraging this power to build a legitimate real estate private finance company in your hometown, while geopolitical winds propel you forward.

Do you prefer grappling with tenants and toilets, or navigating the whims of local politicians who dictate your rent collection? Embrace the transformation from home flipper to real estate private financier, for only then can you claim the title and the rewards it entails. In the long run, it’s unwise to have tenants poorer than yourself.

Success in residential real estate inevitably brings attention, and with it, eager investors. Despite your excitement, you may feel overwhelmed, unsure of the first steps or how to legally and credibly structure your venture. Under mounting pressure, you may plunge headfirst into ill-advised loans, commingling funds, and learning the hard way.

As you juggle sticks of dynamite, one costly mistake at a time, housing authorities and state regulators may become unwelcome guests. Averting this nightmare requires mastering asset valuation, capital management, and raising funds for your private mortgage pool. This newfound knowledge will empower you to lend profitably on commercial real estate, partnering with tenants whose wealth surpasses your own.

As a novice or experienced residential landlord, you depend on bank loans and good credit. However, as a Private Real Estate Financier, you become the bank – your credit is inconsequential, and you hold the reins. The benefits don’t end there.

Residential landlords face fierce competition, often paying near-retail prices for single-family homes and townhouses to rent to economically disadvantaged tenants. This fear-driven approach wreaked havoc on credit scores, assets, and relationships during the 2008 Great Recession.

Private Real Estate Financiers control their investments and lending at the outset. By managing the loan-to-value ratio and risk, you can sleep soundly, knowing you’ve made a prudent choice for your financial future.

Consider what your children and friends think you do as a residential landlord. Do they imagine you evicting single mothers and veterans or renting to unreliable tenants and unsavory characters? Transform into a Private Real Estate Financier and earn the respect and admiration of your peers and long-lost acquaintances.

As a landlord, you risk stagnation, confined to a single asset class that rarely leads to substantial wealth: single-family homes. The Private Real Estate Financier, on the other hand, evolves with time and can fund a variety of ventures – from retail centers to racehorses.

The pandemic has demonstrated the power tenants can wield, with some paying rent at their leisure. Government decisions can jeopardize your solvency, and bankruptcy looms for many residential landlords. Private real estate financiers, however, enjoy stronger protections as first lien holders on private loans, ensuring less risk to their reputation and well-being.

As a residential landlord, you might find yourself dealing with questionable listing agents and disreputable “bird-dogs.” Embrace the role of a Real Estate Private Financier and leave such encounters behind. Diversify your skillset and seize opportunities while insulating yourself from risk. Remember, 97% of residential landlords never evolve beyond their initial ventures, exposing themselves to political and economic hazards.

As a financier, you join the esteemed “buy-side” ranks on Wall Street, wielding the power and making the rules. Fewer in number, Private Real Estate Financiers attract capital by utilizing the right signals. It’s time to choose the path of influence and prosperity – become a Private Real Estate Financier today.

As a Private Real Estate Financier, you wield influence as your most valuable asset. You build a brand that exudes prestige, setting yourself apart from the crowd. While residential landlords struggle at foreclosure auctions against seemingly limitless foreign funds, you, as a financier, tap into a wealth of new opportunities.

With your refined skillset, you can cross over into other private asset classes like commercial real estate. Master the essentials of credit risk and other vital “buy-side” skills that few possess. Experience the real prestige in real estate – click here to embark on your journey as a Real Estate Private Financier.

Residential landlords often face a harsher reality, managing their properties due to overpayment or unhappy marriages. In contrast, Private Real Estate Financiers enjoy a fulfilling lifestyle, making significant returns on other people’s money without the risks and headaches associated with tenants, interest rates, and management issues.

As a financier, you not only amass wealth but also gain influence. There’s no greater accomplishment than earning someone’s trust with their life savings. Reflect on the power and prestige that come with that responsibility.

This book unveils the secrets to establishing your fund, attracting qualified investors, choosing the right projects and borrowers, and structuring risk to protect yourself and your investors. Learn from the costly mistakes of a $15 million fund and avoid the pitfalls that plagued others in this niche.

There’s no better time to launch a career in the prestigious private credit business. Discover the fast track to wealth in the real estate space by thinking like a bank, not a Realtor – earning points, fees, and interest rate spreads on loans using pooled investor money. Remember, banks consistently profit, while residential landlords can easily lose everything.

With this book, you’ll uncover the strategies to qualify and structure deals correctly, ensuring you don’t risk your own or someone else’s money. Take control and minimize risks by following the guidance laid out here. After all, it’s the financiers and lenders who hold the power, not the TV personalities touting house-flipping fame.

Transform your life and career – become a Private Real Estate Financier and experience the rewards of wealth, influence, and prestige.

This groundbreaking book is designed for distinguished Realtors® and established brokers eager to follow in the footsteps of real estate icons like Barbara Corcoran. It’s for ambitious accountants ready to transform long-standing client relationships into wealth creation opportunities. If you’re an Airbnb mogul seeking to scale your business, or a residential landlord preparing for the inevitable market changes, this book is for you.

Discover how to profit from others’ successes and mistakes in real estate, and protect yourself from uncertainties like the 2008 financial crisis. With over 20 years of rich real estate investment experience, from my early days at Goldman Sachs to managing multiple funds and private investment offices, this book delivers the gritty details you need to succeed.

From starting with no capital to understanding the intricacies of institutional fund management, this book has you covered. Gain the confidence to communicate with investors and capitalize on the universal understanding of real estate foreclosures.

Here’s a glimpse of what you can expect from this once highly-priced, now beloved book on real estate investing:

With this book, you’ll benefit from my decades of real estate investment experience and practical know-how. Prepare yourself to tackle the “how-to’s” and those nerve-wracking “what happens next” questions that can only be answered by someone with genuine institutional fund management expertise.

Don’t miss your chance to thrive in the world of real estate investing. Take charge and secure your future with this ultimate guide for ambitious real estate professionals.

Picture yourself as a sought-after real estate financier, playing matchmaker between lenders and rehabbers, earning generous fees from every deal. Imagine being trusted by high-net-worth investors, family offices, and institutions who are eager to entrust you with millions. If you’re ready to take your real estate career to new heights, this guide will show you how.

Discover the essentials of private real estate lending, including:

Learn how to craft a compelling pitch deck, build a distinguished investment committee, and implement fool-proof systems for managing payments, closings, and defaults. Master the art of sourcing deals, understanding fiduciary ethics, and leveraging additional funds.

Develop ethical marketing strategies, define your capital-raising approach, and prepare for the transition to commercial real estate. Benefit from real-life horror stories and invaluable lessons learned from a seasoned professional.

Don’t miss this opportunity to elevate your real estate career and become the prestigious, well-respected professional you’ve always envisioned. With this comprehensive guide, you’ll be armed with the knowledge and confidence to launch your own private credit fund, manage risk expertly, and reap the rewards of your hard work and dedication. The time is now—seize the moment and secure your future in the world of private real estate financing.

Permit me to do something most bookstores wouldn’t dare… I’m offering you a generous 30-day preview of this book. Devour it from cover to cover. Scribble notes in the margins. Highlight to your heart’s content. Put it through its paces. Should you conclude that the modest investment you made wasn’t worthwhile, I’ll refund that investment in full and implore you to keep the Audiobook and Audible versions as a gesture of goodwill for giving it a fair chance.

I have the utmost confidence that you won’t need this guarantee, otherwise, I wouldn’t be so audacious in offering it. Nevertheless, it’s there to quell even the tiniest morsel of doubt that may linger in your mind.

Simply click the button or fill out the brief form on this page right now. You’ll receive instant access to the PDF and Kindle versions of this book, the bonus Audiobook and Audible versions, and the print version will be dispatched to you posthaste. Feel free to return the book even if you’ve made your mark in the margins – no hard feelings.

In this business, money signifies conviction, and my books carry a premium price tag for a reason. Two decades of an impeccable track record and experience won’t be found in a bargain bin. Moreover, this endeavor isn’t for everyone. Many people lack the trust of their friends and peers to raise capital independently.

Thus, it may not be a suitable fit, or worse, it could attract the wrong crowd, jeopardizing the trust of others – and that’s something I cannot abide. So, return the book and enjoy the audio versions as my gift for your efforts.

Now, if you’re still wavering, let me offer you a glimpse of the wisdom you’ll gain from this book…

Listen closely: The most significant hurdle for budding private mortgage pool fund managers is capturing investors’ attention. You see, every middle-class investor vying to invest with you is secretly seeking instant riches. They devour every word on HGTV, though they’d never admit it. So, how do you entice them? By using deadlines and tranches. This way, the early birds in your mortgage pool secure the cream of the crop: higher returns, reduced fees, and so on. Latecomers miss out and must settle for retail fees or diminished returns.

To sweeten the deal, inform your investors that only the first tranche can be funded through self-directed IRAs. Since most of your initial capital will stem from this, it’s wise to light a fire under these investors first. Limit yourself to two tranches, with no more than a three-week gap. Watch your capital raise accelerate with this method.

If there’s one thing the pandemic revealed about human nature, it’s that the fear of missing out is pervasive.

Upon republishing this book, I’ve ordered a mere 150 copies. They’re packaged and primed for shipping. They’ll likely be snapped up in the blink of an eye.

Why, you ask?

The previous release of my book sold 4,150 copies in mere weeks. The price skyrocketed on Amazon, and the rest, as they say, is history. It’s all about supply and demand.

One final note:

Remember those two college classmates I mentioned earlier? The computer science major had exhausted all his credit on homes his Realtor® friends and mortgage broker buddies from college recommended. They seemed knowledgeable, but he later realized they were woefully inept at math.

In the end, he lost everything he’d worked so diligently for, including his family, all because he relied on “free advice.”

This led him to bankruptcy court.

For the very first time, he grasped that the income which had once epitomized success at 28 had transformed into a symbol of failure by 38. In contrast, the other individual, after reading this book, not only managed to pay off his student loans but also acquired the skills to undertake more prestigious commercial projects – even during challenging times. How? By learning to become the bank.

Resting on his desk, beside a cherished photograph of his family in Maui, lies a wooden plaque engraved in Hawaii. It bears the second rule of real estate he learned from me: never stop raising capital.

An Insurance Policy for Your Reputation Every budding real estate entrepreneur who genuinely seeks to excel as a professional real estate financier ought to listen to or read this book no fewer than seven times before investing a single dollar of their own – or others’ money.

This book is invaluable, yet it’s not free for a reason: to distinguish serious, committed men and women from unreliable dreamers and pretenders. It’s designed for those asking themselves, “Where will I be ten years from now?” It’s a call to action for those ready to seize their future and forge a path to lasting success.

Best,

Sal

PS. If you’re like me and skip to the bottom of the letter, I have a deal for you. I’m thrilled to offer you a copy of my 180-page Owner’s Manual on starting and operating your own real estate private lending business. This book outlines the exact formula I’ve used, and many of my readers have used, to raise $34 million in assets under management with $700,000 in fees.

But you’re probably wondering, how can you make money? Let me tell you, one of my readers made an impressive $762,000. Imagine what you could do with this knowledge.

For just $19.95, this limited-time offer is a steal. I’ve only ordered 150 copies, and they’re packed and ready to be shipped. The last time I released a new book, “Investing Legacy: How the .001 Invest,” it sold out in a few short weeks.

You’ll receive the Audible, Audiobook (MP4s), Kindle, and PDF versions instantly. There’s no catch to this offer, no signing up for any trial, or monthly program. And if you don’t like the book, let me know, and I’ll buy it back from you. Just keep the Audible and Audiobook versions as my appreciation for trying it out.

Don’t let another down-cycle or recession in real estate pass you by. This book can change your professional identity immediately and put you in a far different place even 12 months from now.

This book is your gateway drug to financing several other collateral-backed assets, including the most precious of all collateral, ultra-fine art! So click here and claim your copy now. You won’t regret it.